Tuesday, December 31, 2013

Saturday, December 21, 2013

Friday, December 20, 2013

Zuzu's petals are long gone...

It’s a Wonderful Life, for Potter.

Lionel Barrymore as the evil banker "Mr. Potter"

by Nick Paleologos, December 20, 2013

Is there anybody out there who still believes that banks keep

our money safe and make loans to help us buy stuff? Of course not, and here’s

why. Imagine falling asleep in Bedford Falls and waking up in Pottersville. The

Bailey Savings and Loan is long gone. So is good old George Bailey. You’re

drowning. But George isn’t there to save you because Clarence isn’t there to

save him. You see, in this nightmare there is no Clarence.

And its not just the banks. The stock market used to exist to

help companies find capital, until Potter took it over. In the old days, a guy

woke up and decided America needed widgets, and he was just the one to make

them. He went down to the market and convinced some folks to give him money for

his widget business. In exchange, they got shares of stock in his new widget

company. Widget Guy used the money to buy equipment and hire people. If he made

a profit, so did his investors. If he didn’t, they didn’t. Here’s the best

part: whether or not Widget Guy and his investors made money, lots of people

got hired and paid in the process. And lots of real stuff got bought and sold.

Then Potter took over the market and screwed everything up. He

convinced those same investors that they were chumps for buying shares in

Widget Guy’s company. After all, it takes time to build a successful business.

Who wants to wait that long to make money? Potter had a better idea. If

investors liked widgets so much, they should give their money to Potter

instead. He’d find other investors and they could all bet with each other on

the price of widgets. Potter would be the bookie. They could bet on Widget

Guy’s stock price without ever giving him any money at all. When they got bored

with betting on widgets, Potter had a million other things they could bet on:

the price of cars in China; the temperature in Sri Lanka; the rainfall in Iowa;

or for that matter--anything else that moves. Every day Potter came up with

more exotic bets to suck all their investment capital out of the real economy.

How many bets did Potter book while nobody was looking? Let’s

put it this way, the federal budget deficit this year is lower--by half--than

it was four years ago. But it’s still humongous at three quarters of a trillion

dollars. If you add up all the federal budget deficits over the last 200 years

you get the national debt—which is about $16 trillion. At this very moment,

Potter is holding bets (he calls them derivatives) worth approximately $600

trillion. That’s 37 times the national debt—all tied up in betting slips.

And whether Potter’s clients win or lose, Potter always wins because he gets a

fee on every bet. Meanwhile Widget Guy never sees a penny. By the way, the last

time Potter guessed wrong, the rest of us had to cover his losses.

Why? Because Potter also took over the US congress--which

changed all the laws in his favor. Think about it. There was a time when

congress at least pretended to support the notion that everybody should

pay their fair share of taxes. That’s all changed.

Today, the official policy of the United States is: tax

wealth at a lower rate than work. Potter makes $10 million a year and

pays less than half the tax rate of Widget Guy, who earns $100 thousand

a year. And that’s just the tip of a very dirty iceberg. Potter doesn’t pay a

penny more in Social Security taxes than Widget Guy either--despite pocketing a

salary that’s 100 times higher.

On Capitol Hill, Potter decides what’s fair.

On Wall Street, Potter decides what’s right.

Unfortunately, Widget Guy lives on Main Street.

And in Pottersville, Main Street doesn’t have a chance.

Saturday, December 14, 2013

Monday, December 9, 2013

Sunday, December 8, 2013

Senator Dick Durbin: Increasing the minimum wage does NOT kill jobs

“When you go back to the beginning of the minimum wage law

under Franklin Roosevelt, 80 years ago, exactly the same arguments were made

against it. Every time we’ve tried to raise the standard of living for hard

working people at the low end of the income scale, they’ve said “Oh my goodness

you’re just going kill off jobs.”

It isn’t just the minimum wage. It’s making sure that

working Americans have access to affordable health insurance. It’s the earned

income tax credit--that was created under President Ronald Reagan. We’ve got to

make sure they keep up with the needs of working Americans.

These used to be consensus, bi-partisan issues. We’ve got to

get back to that day, or the working folks across America are going to fall

further and further behind.”

---Sen. Richard Durbin on ABC News "This Week"

---Sen. Richard Durbin on ABC News "This Week"

Obama meets Madiba.

In 2005, on a visit to Washington DC, 87 year old Nelson Mandela invited a young freshman Senator over to his hotel. An aid to the Senator, David Katz, snapped this photo--the only picture ever taken of the two men together.

Saturday, December 7, 2013

In 2013, 6 members of the Walton family have more wealth than the bottom 40% of all Americans.

TODAY, THE TOP 10% OF AMERICAN WAGE EARNERS GRAB HALF OF ALL US INCOME--WITH A HUGE CHUNK OF THAT GOING TO THE TOP 1%.

In 1970, US CEO'S EARNED 20 TIMES MORE THAN THE AVERAGE WORKER. TODAY, THEY EARN 300 TIMES MORE THAN THE AVERAGE WORKER.

Wednesday, December 4, 2013

Tuesday, December 3, 2013

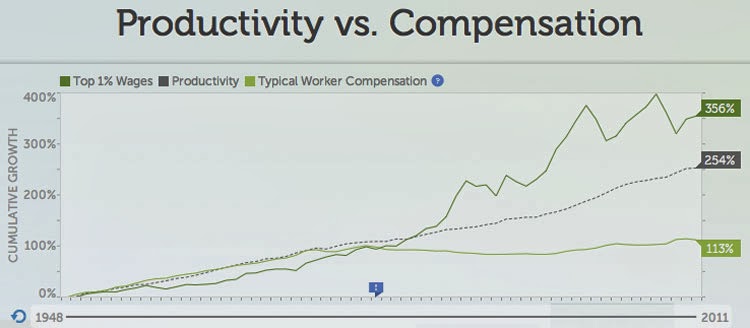

2 charts from former Labor Secretary Robert Reich show what went wrong.

Income inequality rose sharply before the Great Depression. Thankfully, Franklin Roosevelt ushered in tax and regulatory fairness. In the post-Roosevelt years, things got much better. Enter Ronald Reagan in 1980. He slashed taxes, killed consumer protections and the wage gap has widened ever since. This chart shows the dramatic trajectory of income inequality since 1920:

WAGE GAP SINCE 1920

From the end of WWII until 1980, as productivity increased, so did wages (of both the top 1% and the average worker)--at about the same rate. Then, beginning in 1980, productivity kept going up. So did the income of the top 1%. But the typical worker's income stopped rising. Pretty much all of the wealth created went to the top 1%. This chart clearly illustrates the grotesque inequity caused by massive tax cuts and deregulation.

Sunday, November 24, 2013

Friday, November 15, 2013

If just one of these CEO's went to jail, would this crap keep happening?

Record get-out-of-jail fees: Ruining your life is just a cost

of doing business.

$246 billion fine — Tobacco industry combined — 1998: After decades of lying about the connection between cigarettes and lung cancer, the five largest tobacco makers in the country, Philip Morris, R.J. Reynolds, Brown & Williamson, Lorillard and Liggett & Meyers agreed to pay out $246 billion over the course of 25 years ending in 2025. The companies had reached earlier agreements with some states and then reached a wide settlement with the remaining 46.

$25 billion fine — Wells Fargo & Co., J.P. Morgan Chase & Co., Citigroup Inc., Bank of America Corp., Ally Financial Inc. — 2012: These five banks agreed to pay $25 billion in penalties and borrower relief over alleged foreclosure processing abuses.

$25 billion fine — Wells Fargo & Co., J.P. Morgan Chase & Co., Citigroup Inc., Bank of America Corp., Ally Financial Inc. — 2012: These five banks agreed to pay $25 billion in penalties and borrower relief over alleged foreclosure processing abuses.

$13 billion fine – JPMorgan

Chase & Co. –

October 2013: J.P. Morgan announced a record $13 billion

settlement with

the Department of Justice and other federal regulators over mortgage-backed securities abuses. The deal reportedly

includes homeowner assistance payments and fines, it would be the biggest fine

ever levied by the US Department Of Justice.

$9.3 billion fine — Bank of America, Wells Fargo,

J.P. Morgan and 10 others — 2013:

Thirteen banks reached an agreement with the Office of the Comptroller of the

Currency and Federal Reserve to pay $9.3 billion in cash and noncash relief,

including loan assistance, to homeowners over alleged foreclosure

abuses.

$8.5 billion fine — Bank of America

– June 2011: The bank has paid billions in settlements since

the financial crisis, most of them tied to bad

mortgages churned out by Countrywide before it’s collapse and rescue by

Bank of America. The biggest settlement it reached,

for $8.5 billion, was not with the government but with a group of mortgage bond

holders including BlackRock, Pimco and the New York Federal Reserve. The

settlement is still awaiting a judge’s approval.

$4.5 billion fine – JPMorgan

Chase & Co. –

November 2013: JPMorgan Chase & Co. has reached a $4.5

billion settlement with investors over toxic mortgage-backed

securities. The settlement, announced Friday, covers 21 major

institutional investors, including competitor Goldman Sachs, BlackRock

Financial Management, and Metropolitan Life Insurance Co. The mortgage-backed

securities were sold by JPMorgan — the biggest U.S. bank — and Bear Stearns

between 2005 and 2008.

$4.5 billion fine – BP

– November 2012: BP’s fines for Deepwater Horizon

oil spill disaster in the Gulf of Mexico

included what was the biggest fine ever levied by the Department of Justice: $4

billion. That came along with $525 million more to the SEC for civil penalties.

The DOJ penalty also had an

accompanying guilty plea to

11 felony counts of “seaman’s manslaughter”

relating to the deaths aboard the drilling rig, admitting that its workers were

negligent when they misinterpreted a key well safety test. Meanwhile, the oil

giant earlier in 2012 agreed to pay victims an estimated $7.8 billion and have

in total booked charges of about $42 billion for cleanup and settlement

payments. It is in a court trial over environmental penalties that could total

billions more.

$3 billion fine –

GlaxoSmithKline – July 2012: In

what was billed as the largest healthcare settlement with

the DOJ ever, the drugmaker paid $3 billion

and pleaded guilty to criminal charges of illegally

marketing drugs and withholding safety data from U.S. regulators.

$2.3 billion fine — Pfizer Inc.

— 2009: The pharmaceutical giant pleaded guilty to a federal criminal charge of illegally

marketing the painkiller Bextra and paid $2.3 billion for illegally

promoting the sale of that and other medicines for unapproved uses.

$1.9 billion fine — HSBC Holdings

– HSBC agreed to pay $1.9 billion to U.S.

authorities over money-laundering abuses. U.S. officials hailed the settlement as

the largest penalty ever under the Bank Secrecy Act. The agreement between the

U.S. and HSBC also represented the third time since 2003 the bank agreed to

U.S. orders to cease lax conduct and correct failed policies.

$1.6 billion fine — Abbott Laboratories

— 2012: The drug maker agreed to pay $1.6

billion and pleaded guilty to violating a federal drug law

following allegations that the company improperly promoted antiseizure drug

Depakote for unauthorized uses.

$1.6 billion fine — Siemens

— 2008: Siemens agreed to pay a total of $1.6 billion in

fines and penalties to U.S. and German authorities to resolve allegations of a bribery scheme across several countries to win

business.

$1.5 billion fine — UBS AG

— 2012: UBS agreed to pay $1.5 billion and acknowledged

charges that it had manipulated interbank lending rates

including the London interbank offered rate, or Libor.

It was the biggest fine so far in that scandal.

$1.5 billion fine – Intel – 2009 – The chip maker was walloped with the biggest antitrust fine ever by the European Union. The company, at the time, controlled about 80% of the world’s computer chips. Intel is still appealing the fine and has said the EU is mistaken. The largest U.S. antitrust fine ever has been $500 million, levied twice, including last year in a case against LCD television maker AU Optronics Corporation of Taiwan.

$1.42 billion fine — Eli Lilly & Co. — 2009 : Eli Lilly agreed to pay $1.42 billion to settle a probe into alleged improper marketing of the antipsychotic drug Zyprexa.

$1.42 billion fine — Eli Lilly & Co. — 2009 : Eli Lilly agreed to pay $1.42 billion to settle a probe into alleged improper marketing of the antipsychotic drug Zyprexa.

$1.4 billion fine — 10 Wall Street firms including Goldman Sachs, Morgan Stanley and J.P. Morgan

— 2003: The 10 firms agreed to pay penalties of roughly

$1.4 billion to settle charges of conflicts of interest

between their research and investment banking sectors.

$950 million fine — Merck & Co.

— 2011: Merck agreed to pay $950 million and plead

guilty to a criminal misdemeanor charge to resolve government allegations that

the company illegally promoted its former painkiller

Vioxx and deceived the government about the drug’s safety.

$900 million fine – Exxon

– 1991 – The oil company agreed to settle all federal and

state civil claims resulting from the Exxon Valdez oil

spill of March 24, 1989 with a payment of $900 million and the

possibility for $100 million more. Three decades later, the sides

continued to argue about the $100 million more.

Tuesday, November 12, 2013

Tuesday, October 29, 2013

Friday, October 25, 2013

Tuesday, October 22, 2013

Generally speaking, we hate each other. Specifically, we agree on pretty much everything.

Solving our biggest national

problems is a very simple matter -- on paper. The major obstacle to progress in

America is the annoying tendency of our political leaders to speak in useless

generalities.

Republicans: “We will never

vote to raise taxes.” Hooray!

Democrats: “We will never

vote to cut social security.” Woohoo!

Why are lawmakers so afraid of

having a civil conversation on the specifics?

Today, somebody earning $113

million a year doesn’t pay a penny more in social security taxes than somebody

making $113 thousand a year. Most rational Republicans think that’s

ridiculous. But as long as their “leaders” keep calling a fair fix a “tax

increase,” inequity will prevail.

Conversely, there are now 400

percent more Americans -- age 65 or older -- than there were in 1940. And they

are living an average of five years longer. Most rational Democrats think a

modest increase in the eligibility age for social security is perfectly

reasonable. But as long as their “leaders” continue to characterize common

sense as a “benefit cut,” nothing will ever happen.

It’s not just social security.

The same is true for almost any “difficult” issue you can imagine.

Most Republicans

believe background checks should be required before buying a gun. Democrats

agree. Yet there are no background checks.

Most Democrats

accept the proposition that the path to citizenship for undocumented immigrants

should be long and tough. Republicans agree. Yet there is no immigration

reform.

Most Republicans think it’s

absurd that the government can’t shop around for the lowest price when it comes

to prescription drugs for seniors. Democrats agree. Yet the drug lobby still

trumps the taxpayers.

Both conservatives and

liberals believe that our allies should be shouldering a larger share of the

cost of their own national defense. Yet overseas military spending is still off

the charts.

Ditto taxes. I can’t find

anybody who actually believes that a hospital worker in America should pay a

higher effective tax rate than a hedge fund manager. Can you?

If politicians actually got

down to the specifics of almost any major public policy issue, party labels and

political ideologies would magically give way to good old fashion common sense.

Unfortunately, in Congress these days, common sense is not so common.

There are a million reasons

for this -- chief of which is a rightfully ticked off public that hasn’t seen

any progress in their paychecks for more than three decades. And the fact that

JP Morgan Chase just agreed to pay a record $13 billion fine for ripping the

heart and soul out of everybody’s most important asset -- their home -- doesn’t

even begin to heal that wound.

Sure, we’re angry. And yes,

there are many other factors: gerrymandering, Citizens United, talk radio, 24/7

cable news networks -- pick your poison. Legislators, lobbyists, and luminaries

of the chatter class all profit handsomely from a polarizing and ultimately

paralyzing focus on the general at the expense of the specific.

Just look at the recent government

shutdown. Standard & Poor’s pegged the cost to the country during a fragile

recovery at $24 billion which translates into a

half point in lost GDP this quarter. Yet Ted Cruz’s campaign coffers are

millions of dollars richer.

The New York Times’ editorial

page assessed the damage to American economic growth since 2010 as: “over $300

billion in lost output and roughly 2 million fewer jobs than would otherwise

have been the case.”

Never raise taxes? Never cut

spending?

The time has come for us to

insist that when it comes to governing, leaders on both sides should never say

never again. As long as reckless political behavior is rewarded with

re-election, politicians will always vote to protect their own jobs -- even if

it costs you yours.

Sunday, October 20, 2013

Congress is killing us

EDITORIAL

October 19, 2013

October 19, 2013

THE HIGH COST OF LOW POLITICS

It was never wise or necessary to cut the deficit while the economy remained weak. The political imperative to do so, driven by Republicans and clumsily adopted by Democrats, has had devastating results. Over the past three years, the depth and pace of federal spending cuts have reduced growth by about 0.7 percentage point, equivalent to over $300 billion in lost output and roughly 2 million fewer jobs than would otherwise have been the case. That so-called fiscal drag has been the single biggest weight on economic growth.

To the extent that deficit reduction is politically unavoidable, Mr. Obama and the Democrats should insist that it come mainly from higher taxes rather than spending cuts. Tax increases on high-income individuals and large corporations are less damaging to the economy than deep spending cuts, and income tax increases to date have affected only a fraction of the top 1 percent of filers, leaving room to raise taxes at the top of the income ladder without harming the economy.

Forcing Republicans to relent for now in their extortionate ways is a tactical victory for Mr. Obama and Congressional Democrats in the long budget war. What’s still needed is a budget that taxes and spends with the aim of boosting the economy so that the majority of Americans will, at long last, begin to benefit from the recovery.

Thursday, October 10, 2013

Wednesday, October 9, 2013

Monday, October 7, 2013

Friday, October 4, 2013

Tom Friedman nails it...again.

OP-ED COLUMNIST

Our Democracy Is at Stake

October 1, 2013

This time is

different. What is at stake in this government shutdown forced by a radical Tea

Party minority is nothing less than the principle upon which our democracy is

based: majority rule. President Obama must not give in to this hostage taking —

not just because Obamacare is at stake, but because the future of how we govern

ourselves is at stake.

What we’re seeing here is how three structural

changes that have been building in American politics have now, together,

reached a tipping point — creating a world in which a small minority in

Congress can not only hold up their own party but the whole government. And

this is the really scary part: The lawmakers doing this can do so with high

confidence that they personally will not be politically punished, and may, in

fact, be rewarded.

When extremists feel that insulated

from playing by the traditional rules of our system, if we do not defend those

rules then our democracy is imperiled.

This danger was neatly captured by Washington Post columnist Dana Milbank, when he wrote: “Democrats

howled about ‘extortion’ and ‘hostage taking,’ which Boehner seemed to confirm

when he came to the floor and offered: ‘All the Senate has to do is say ‘yes,’

and the government is funded tomorrow.’ It was the legislative equivalent of

saying, ‘Give me the money and nobody gets hurt.’ ”

“Give me the money and nobody gets

hurt.” How did we get here?

First, by taking gerrymandering to a new level.

The 2010 election gave Republican state legislatures around the

country unprecedented power to redraw political boundaries, which they used to

create even more “safe, lily-white” Republican strongholds that are, in effect,

an “alternative universe” to the country’s diverse reality.

Between 2000 and 2010, the number of

strongly Democratic districts decreased from 144 before redistricting to 136

afterward. The number of strongly Republican districts increased from 175 to

183. “Republicans would need to mess up pretty badly to lose their House majority in the near future,” said Republican analyst Charlie Cook. The numbers suggest that the fix is in for any election

featuring a fairly neutral environment. In other words,

there is little risk of political punishment for the Tea Party members now

holding the country hostage.

Meanwhile, there's the Supreme Court’s inane

Citizens United decision. Last month, for the first time ever in Colorado, two state

senators who voted for universal background checks on gun purchases lost their

seats in a recall election engineered by gun extremists and reportedly financed

with some $400,000 from the National Rifle Association. You’re elected, you

vote your conscience on a narrow issue, but now determined opponents don’t have

to wait for the next election. With enough money, they can get rid of you in

weeks.

Finally, the rise of a separate

G.O.P. (and a liberal) media universe — from talk-radio hosts, to Web sites to

Fox News — has created another gravity-free zone, where there is no punishment

for extreme behavior, but there’s 1,000 lashes on Twitter if you deviate from

the hard-line and great coverage to those who are most extreme.

When

politicians only operate inside these bubbles, they lose the habit of

persuasion and opt only for coercion. After all, they must be right. Rush

Limbaugh told them so.

These “legal” structural changes in

money, media and redistricting are not going away. They are superempowering

small political movements to act in extreme ways without consequences and

thereby stymie majority rule.

If democracy means anything, it means that, if

you are outvoted, you accept the results and prepare for the next election.

Republicans are refusing to do that. It shows contempt for the democratic

process.

President Obama is not defending

health care. He’s defending the health of our democracy. Every American who

cherishes that should stand with him.

Subscribe to:

Comments (Atom)