Tuesday, December 31, 2013

Saturday, December 21, 2013

Friday, December 20, 2013

Zuzu's petals are long gone...

It’s a Wonderful Life, for Potter.

Lionel Barrymore as the evil banker "Mr. Potter"

by Nick Paleologos, December 20, 2013

Is there anybody out there who still believes that banks keep

our money safe and make loans to help us buy stuff? Of course not, and here’s

why. Imagine falling asleep in Bedford Falls and waking up in Pottersville. The

Bailey Savings and Loan is long gone. So is good old George Bailey. You’re

drowning. But George isn’t there to save you because Clarence isn’t there to

save him. You see, in this nightmare there is no Clarence.

And its not just the banks. The stock market used to exist to

help companies find capital, until Potter took it over. In the old days, a guy

woke up and decided America needed widgets, and he was just the one to make

them. He went down to the market and convinced some folks to give him money for

his widget business. In exchange, they got shares of stock in his new widget

company. Widget Guy used the money to buy equipment and hire people. If he made

a profit, so did his investors. If he didn’t, they didn’t. Here’s the best

part: whether or not Widget Guy and his investors made money, lots of people

got hired and paid in the process. And lots of real stuff got bought and sold.

Then Potter took over the market and screwed everything up. He

convinced those same investors that they were chumps for buying shares in

Widget Guy’s company. After all, it takes time to build a successful business.

Who wants to wait that long to make money? Potter had a better idea. If

investors liked widgets so much, they should give their money to Potter

instead. He’d find other investors and they could all bet with each other on

the price of widgets. Potter would be the bookie. They could bet on Widget

Guy’s stock price without ever giving him any money at all. When they got bored

with betting on widgets, Potter had a million other things they could bet on:

the price of cars in China; the temperature in Sri Lanka; the rainfall in Iowa;

or for that matter--anything else that moves. Every day Potter came up with

more exotic bets to suck all their investment capital out of the real economy.

How many bets did Potter book while nobody was looking? Let’s

put it this way, the federal budget deficit this year is lower--by half--than

it was four years ago. But it’s still humongous at three quarters of a trillion

dollars. If you add up all the federal budget deficits over the last 200 years

you get the national debt—which is about $16 trillion. At this very moment,

Potter is holding bets (he calls them derivatives) worth approximately $600

trillion. That’s 37 times the national debt—all tied up in betting slips.

And whether Potter’s clients win or lose, Potter always wins because he gets a

fee on every bet. Meanwhile Widget Guy never sees a penny. By the way, the last

time Potter guessed wrong, the rest of us had to cover his losses.

Why? Because Potter also took over the US congress--which

changed all the laws in his favor. Think about it. There was a time when

congress at least pretended to support the notion that everybody should

pay their fair share of taxes. That’s all changed.

Today, the official policy of the United States is: tax

wealth at a lower rate than work. Potter makes $10 million a year and

pays less than half the tax rate of Widget Guy, who earns $100 thousand

a year. And that’s just the tip of a very dirty iceberg. Potter doesn’t pay a

penny more in Social Security taxes than Widget Guy either--despite pocketing a

salary that’s 100 times higher.

On Capitol Hill, Potter decides what’s fair.

On Wall Street, Potter decides what’s right.

Unfortunately, Widget Guy lives on Main Street.

And in Pottersville, Main Street doesn’t have a chance.

Saturday, December 14, 2013

Monday, December 9, 2013

Sunday, December 8, 2013

Senator Dick Durbin: Increasing the minimum wage does NOT kill jobs

“When you go back to the beginning of the minimum wage law

under Franklin Roosevelt, 80 years ago, exactly the same arguments were made

against it. Every time we’ve tried to raise the standard of living for hard

working people at the low end of the income scale, they’ve said “Oh my goodness

you’re just going kill off jobs.”

It isn’t just the minimum wage. It’s making sure that

working Americans have access to affordable health insurance. It’s the earned

income tax credit--that was created under President Ronald Reagan. We’ve got to

make sure they keep up with the needs of working Americans.

These used to be consensus, bi-partisan issues. We’ve got to

get back to that day, or the working folks across America are going to fall

further and further behind.”

---Sen. Richard Durbin on ABC News "This Week"

---Sen. Richard Durbin on ABC News "This Week"

Obama meets Madiba.

In 2005, on a visit to Washington DC, 87 year old Nelson Mandela invited a young freshman Senator over to his hotel. An aid to the Senator, David Katz, snapped this photo--the only picture ever taken of the two men together.

Saturday, December 7, 2013

In 2013, 6 members of the Walton family have more wealth than the bottom 40% of all Americans.

TODAY, THE TOP 10% OF AMERICAN WAGE EARNERS GRAB HALF OF ALL US INCOME--WITH A HUGE CHUNK OF THAT GOING TO THE TOP 1%.

In 1970, US CEO'S EARNED 20 TIMES MORE THAN THE AVERAGE WORKER. TODAY, THEY EARN 300 TIMES MORE THAN THE AVERAGE WORKER.

Wednesday, December 4, 2013

Tuesday, December 3, 2013

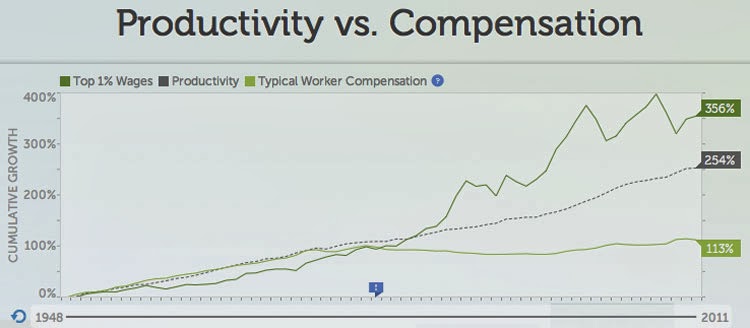

2 charts from former Labor Secretary Robert Reich show what went wrong.

Income inequality rose sharply before the Great Depression. Thankfully, Franklin Roosevelt ushered in tax and regulatory fairness. In the post-Roosevelt years, things got much better. Enter Ronald Reagan in 1980. He slashed taxes, killed consumer protections and the wage gap has widened ever since. This chart shows the dramatic trajectory of income inequality since 1920:

WAGE GAP SINCE 1920

From the end of WWII until 1980, as productivity increased, so did wages (of both the top 1% and the average worker)--at about the same rate. Then, beginning in 1980, productivity kept going up. So did the income of the top 1%. But the typical worker's income stopped rising. Pretty much all of the wealth created went to the top 1%. This chart clearly illustrates the grotesque inequity caused by massive tax cuts and deregulation.

Subscribe to:

Posts (Atom)